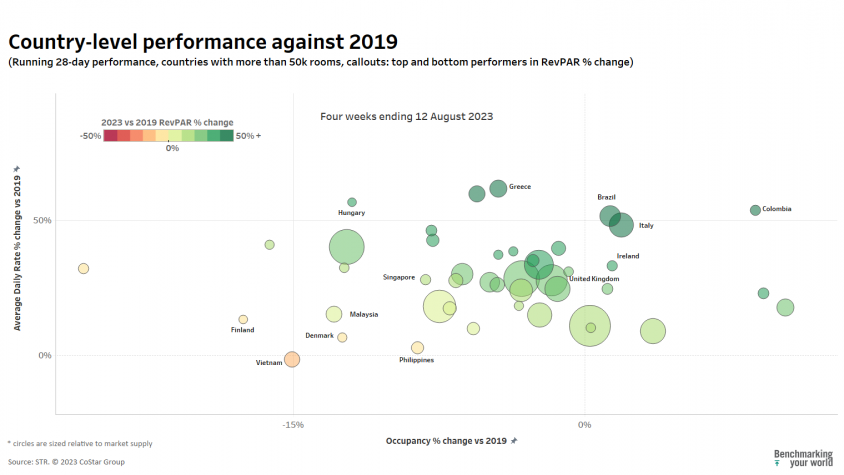

STR's global “bubble chart” update through 12 August 2023 shows a robust 88% of markets experiencing growth in revenue per available room (RevPAR) compared to 2019. That figure was slightly lower than the 90% seen during the previous update, which marked the highest proportion of markets in that category since this series began in May 2022.

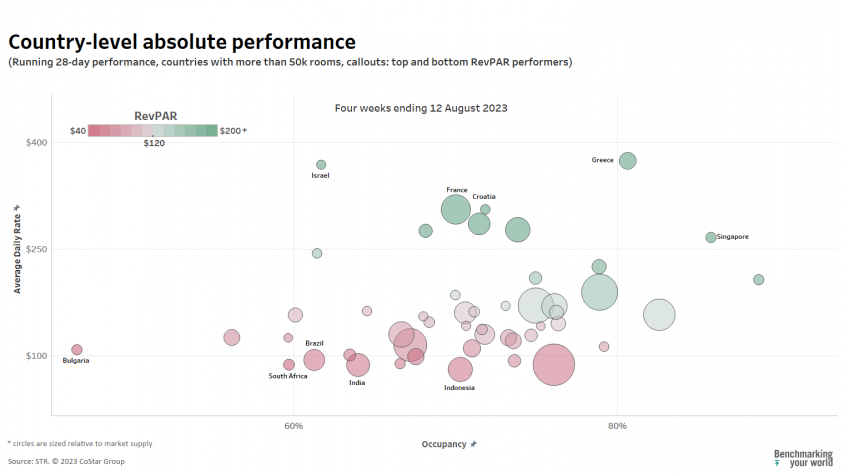

Among all countries with a total supply of more than 50,000 rooms, Israel, France, Greece, Singapore, and Croatia led in RevPAR on an actual basis. Greece maintained the top spot despite the impact of wildfires, while Singapore rejoined the leaderboard after a brief hiatus.

The countries that recorded occupancy above 80% were the same as the last update, including Greece, Singapore, and the United Kingdom. At the same time, each of the three experienced a decline in the indicator ranging between 2% and 9%.

Notably, Ireland posted a 1% increase from the 2019 comparable to 89%, marking the fourth consecutive 28-day period in which the country has recorded an occupancy rate above 80%.

Greece, Italy, and Colombia retained the top spots in RevPAR growth compared to 2019 and were joined by Hungary and Brazil. Despite ranking among the lowest in terms of actual RevPAR performance, Brazil's performance significantly surpassed that of 2019.

Countries that are behind 2019 RevPAR have remained consistent, with Vietnam being the only country showing both occupancy and average daily rate (ADR) behind the comparable period of 2019.

Excluding provincial, country-level, and markets with fluctuating exchange rates, the top five RevPAR performers among city-level markets were Rio de Janeiro, Sanya, Brisbane, Milan, and Rome. Rio de Janeiro saw exceptional growth in both ADR and occupancy, at +72% and +19%, respectively.

Last month's update highlighted positive momentum in China's markets, with 85% of its markets surpassing their 2019-level RevPAR. The same percentage of markets in China also experienced a recovery in this indicator. However, major cities are not following the recovery trend; Beijing, Guangzhou, and Shenzhen have seen their performance fall behind 2019 levels with Shenzhen experiencing the most significant decline at -24%.

This article originally appeared on STR.