Global Performance

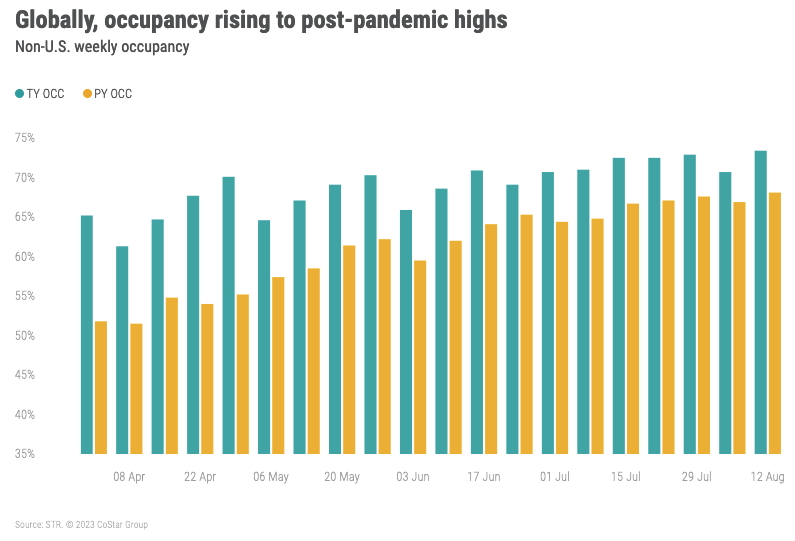

Global occupancy (excluding the U.S.) rose 5.3pts YoY to 73.4%, which was once again the highest post-pandemic level. ADR grew 11.4% YoY to US$156, resulting in a 20% gain in RevPAR. The top 10 countries, based on supply, also posted a post-pandemic occupancy high (75.8%), up 6.1ppts YoY. ADR growth remained strong, up 7.5% YoY with RevPAR advancing 17% to US$110, the second highest level since March 2020.

Outside of the top 10, the countries with highest occupancy for the week by continent were:

- Middle East & Africa: Mauritius 80.4% (+1ppt YoY)

- Europe: Ireland 91.6% (+4.5ppts YoY)

- Asia Pacific: Fiji 84.4% (+2.3ppts YoY)

- Americas: Trinidad and Tobago (+15.1ppts YoY)

Mainland China reported its highest weekly occupancy (78.3%) going all the way back to the first week in 2019. Tier one cities (Beijing, Shanghai, Guangzhou, Shenzhen) have posted an average YTD index vs. 2019 of 93, whereas leisure destinations have performed better than 2019. For example, Sanya and inner Mongolia have indexed for occupancy at 117 and 105, respectively. Until last month, Hong Kong and Macau had been trailing tier one cities, now they are ahead as both posted their highest occupancy since March 2020 at 84.5% and 91.6%, respectively.

U.S. Performance

As summer draws to a close, U.S. hotel occupancy trended down as expected, losing 0.6 percentage points (ppt) from the prior week. The industry’s level of 68.3% was unchanged from a year ago but down 3.3 ppts from the same week in 2019.

Leisure travel will abate further as the new school year begins. This past week, 36% of U.S. K-12 students were back in school and well over half (64%) will be back during the week ending 19 August, according to STR’s 2023-24 School Break Report. We expect demand to continue slowing until after Labor Day and then stabilize with the start of the peak group travel season. Revenue per available room (RevPAR) increased 2.0% year over year (YoY) to US$107, driven by a 2.1% increase in average daily rate (ADR) to US$156. ADR gains have been below the rate of inflation (~3%) for the past 12 weeks, but growth has improved to above 2% in the past three weeks. Real (inflation-adjusted) ADR remained just under the 2019 level.

The Top 25 Markets continued to record stronger occupancy growth compared to the rest of the country, rising 1.6ppts YoY to 71.7%, which was slightly higher than the previous week’s level of 71.4%. Over the past 32 weeks, the Top 25 Markets have seen stronger occupancy gains than the rest of the country in all but two weeks. Compared to the same week in 2019, Top 25 Market occupancy was down 3.7ppts. Outside the Top 25, occupancy was 66.5%, which was down slightly YoY (-0.8ppts) and 1.1ppts lower than the prior week. Compared to the same week in 2019, the rest of the country was down 3.0ppts. RevPAR for the Top 25 Markets increased a healthy 5.4%, which was the second highest YoY gain this summer fueled by an ADR increase of 3.1%. For the rest of the country, ADR grew 1.1%, but with occupancy decline, RevPAR was down 0.2% among that grouping.

Day-of-week performance across the Top 25 Markets showed weekday (Monday-Wednesday) and shoulder (Sunday and Thursday) occupancy producing the strongest YoY increase (+1.8ppts), while weekends increased 1.1ppts YoY. This pattern continued with healthy ADR gains for shoulder and weekday periods, yielding YoY RevPAR gains of +6.4% for weekdays and +5.8% for shoulders. Weekend RevPAR increased 3.8%. Across the rest of the country, occupancy across all day parts were down with weekdays decreasing the least (-0.3ppts). ADR comparisons were positive for all week parts but not enough to produce positive RevPAR changes, except for weekdays (+1.9% YoY). RevPAR for shoulder days and weekends decreased 1.2% and 1.7%, respectively.

The nation’s highest occupancy was in Alaska (88.9%) followed by Portland, ME (88.6%) and Oahu (87.8%). The deadly fires on Maui Island and ensuing evacuations to Oahu likely contributed to the 5.7ppts occupancy gain. The two other Hawaiian markets, Maui (57.1% occupancy) and Hawaii/Kauai Islands (76.0% occupancy) recorded WoW occupancy declines of -14ppts and -5.1ppts, respectively. Comparing to the same week last year, these two markets saw occupancy declines of -16.7ppts and -6.9ppts. The next weeks will be challenging for the entire island as displacement and recovery efforts upend a region that is renowned for and dependent on travel and hospitality.

Besides Oahu, other Top 25 Markets recording occupancy above 80% were Las Vegas (86.2%), New York (83.6%), Los Angeles (82.6%), Seattle (82.5%), San Diego (82.4%), and Boston (81.7%). Los Angeles saw the highest RevPAR increase (+23%) among the Top 25 Markets as occupancy increased 9.8ppts to 82.5% along with an 8.4% ADR gain. Taylor Swift played three of her six sold-out nights at SoFi Stadium this past week, boosting Los Angeles’ weekday (Monday-Wednesday) ADR by 15%

Among the chain scales, occupancy remained the highest in Upscale (73.9%), Upper Midscale (71.4%) and Upper Upscale (70.8%). Midscale occupancy (65.2%) declined 0.7ppts with economy occupancy (59.4%) falling 2ppts. Occupancy in the economy chain scales has been below 2019 since mid-March with the most recent week’s gap at 2.5ppts.

Group demand among Luxury and Upper Upscale hotels, which is generally slow during this time of year, increased 0.9% compared to the same week last year. Over the past four weeks, group demand was up 2.0% compared to the same four weeks last year. Boston, Dallas, and Houston saw group occupancy increase by more than 20% for the week and over the past four weeks. We expect the group segment to show week-over-week decreases but year-over-year gains through the Labor Day holiday followed by strong absolute demand up until the holidays.

Final thoughts

U.S. demand has flattened overall compared to a year ago, but travel remains strong given that air travel, based on weekly TSA screenings, has been above 2019 levels in 22 of the past 23 weeks. We believe the industry is in a period of normalization as it re-adjusts to seasonal patterns. There are some adjustments seen in terms of stronger demand in the Top 25 Markets while the rest of the country slows as well as strength across all markets on weekdays. With summer’s end on the horizon, the industry is counting on business/group travel to advance, further propelling the industry’s return to normal. Outside the U.S., growth is strong on easier comparisons, which will linger through most of the year.

Looking ahead

U.S. occupancy is experiencing the normal seasonal decline, heading toward a summer seasonal low in the week containing Labor Day. Then a gradual rise is expected, but the magnitude of that rise is dependent on the strength of groups and the continued recovery in business transient demand. Global occupancy will likely reach its peak in the coming weeks and then also trend down as school begins in many parts of the world.

This article originally appeared on STR.