Sunshine, culture, and convenience result in consistently strong hotel performance during summer in Spain. This key European destination attracts a wide mix of visitors from across the globe, many of whom opt for a lengthy resort getaway whilst others enjoy shorter city breaks. Within this analysis, we combine STR’s historical and forward-looking data to understand just how demand behaves in different markets depending upon the type of traveller being targeting.

Relaxation, sun and island living are in high demand

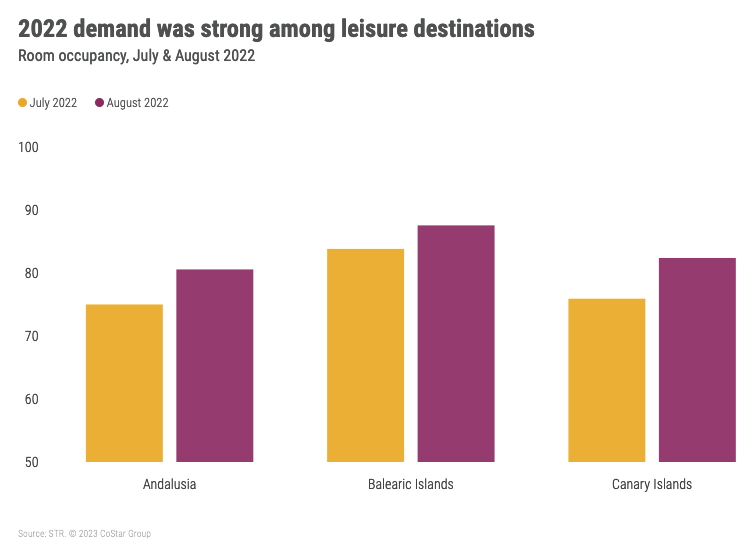

Leisure demand in the Northern Hemisphere is naturally at its peak throughout the summer months of July and August. This correlates with the more favorable weather conditions and alignment with school breaks. During this time, hotels in countries such as Spain can expect to see strong levels of demand that drive pricing power. When we examine performance from last summer across three key leisure markets, Andalusia, the Balearic Islands and the Canary Islands, we see levels of success in both occupancy and room rates that are positioned to repeat in 2023.

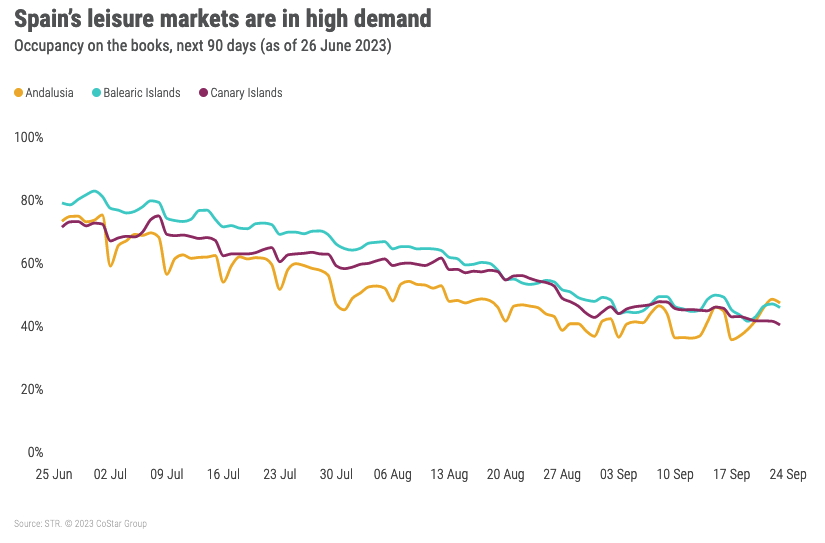

Last year demand surged significantly in August with all three destinations filling 80% or more of rooms. Leading the way was the Balearic Islands, peaking at 88% for August 2022. A great deal of this demand could be observed as from 27 June 2022, with Forward STAR data at that time showing occupancy on the books at 44% at the end of the month and rising to 70% at the start of July. This suggests that bookings for the region are secured fairly well in advance of guests’ arrival dates with only a small percentage of demand coming in at the last minute. Upon review of this year’s forward-looking data, we find occupancy on the books already exceeding those levels, indicating another strong couples of months on the horizon.

In 2022, high leisure demand was also observable on the mainland, in the popular destination of Andalusia. Occupancy sat at 80% for August whilst rates hit EUR181.31 in the same period. Looking at occupancy on the books for July and August of 2023, levels are high, already reaching heights of 70%, yet noticeably it is weekday bookings leading to numerous peaks and troughs. That is a trend far less pronounced in the Canary and Balearic Islands.

Can urban destinations handle the heat?

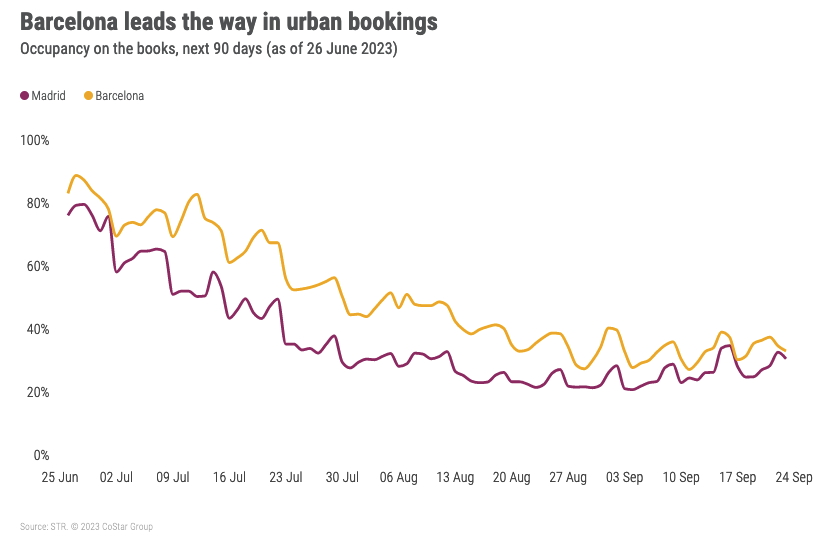

When it comes to urban destinations in Spain, the countries two standout performers for driving visitors are Madrid and Barcelona, each with their own unique appeals. Utilizing Forward STAR’s data for the next 90 days (as of 26 June), a number of key trends have become apparent within these markets.

Barcelona is leading the way throughout the entirety of July and August with occupancy on the books spiking at 83% for 12 July and many other days sitting well above 70% across the rest of the period. By comparison, Madrid peaks at a rate of 76% on July 1, and from here onward, does not show a level lower than 66%.

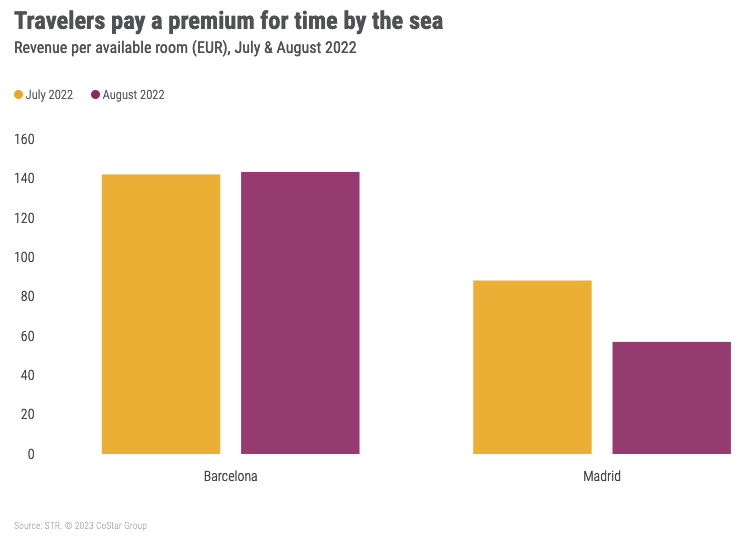

A similar situation occurred in the previous year with Barcelona outpacing the Spanish capital across actualized demand and rates. Revenue per available room (RevPAR), the gold standard for measuring top-line performance, was dominated by Barcelona at EUR143.52 in August and an equally respectable EUR142.26 in July. Madrid’s performance was comparably much weaker, reaching only EUR88.27 EUR for July.

Despite each city being urban in nature, there is one key factor that allows Barcelona to pull away during the summer months, which is its proximity to the coast. This is a key consideration for many travellers looking to relax in the often-intense heat.

The season ahead

STR’s unique ability to review performance data both in a historical capacity as well as in the future provides an indication as to how the 2023 summer season will play out for Spain’s key markets. It is reasonable to assume as we progress into the heart of the high season, the markets likely to come out on top in relation to occupancy are the Balearic and Canary Islands. With bookings already sitting above 70%, and with a select few dates already over 80%, the months ahead present plenty of revenue opportunity for hoteliers in the region.

From a room rate perspective, the Balearics are likely to lead the way given last year’s standout performance in August. However, it should also be noted that if history was to repeat itself, Barcelona is also likely to enjoy a rewarding summer for room revenue after achieving the second highest rates in the country in 2022 (EUR171.23).

Given the climate and the geographical location of Madrid, it is unlikely that demand and rates will rank close to its counterparts focused on leisure. However, if properties are able to maximize their revenue, potential still exists for a profitable couple of months ahead.

This article originally appeared on STR.