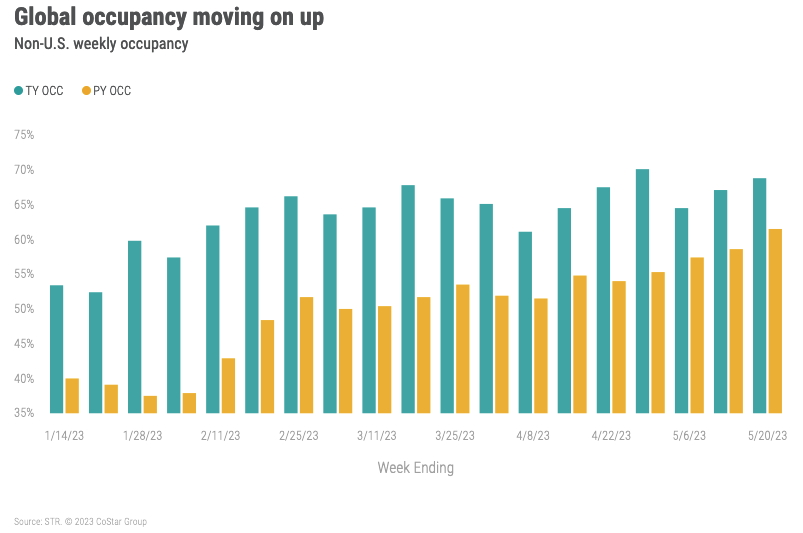

Global occupancy (excluding U.S.) was 68.8% for the week, up 7.3 ppts from the comparable week last year. Occupancy has indexed at 97% of 2019 values for the past six weeks.

U.S. Performance

U.S. hotel industry occupancy came in at 67.5%, which tied for the highest level of the year with 12-18 March 2023. Occupancy increased 2.4 percentage points (ppts) from the previous week but dipped 1.0 ppts year over year. Most of this decline was due to the calendar shift around Mother’s Day.

- Sunday occupancy was 6.4 ppts lower than the matched Sunday (non-Mother’s Day) last year.

- There was also some softness on the weekend (-0.6 ppts) compared to last year, likely also driven in part by Mother’s Day.

- Mid-week (Tuesday – Thursday) occupancy increased slightly compared to last year (+0.7 ppts) with Wednesday increasing 1.2 ppts to the highest Wednesday level (69.8%) this year.

Average daily rate (ADR) at US$159 was US$3.53 higher than the prior week and a 3.6% increase year over year (YoY). The increase was just behind the most recent CPI-indexed annual inflation rate (5.0%).

- Increasing occupancy and ADR netted a healthy revenue per available room (RevPAR) increase of US$6.17 week over week (WoW) to US$107, which was up 2.2% YoY.

- RevPAR and ADR for the week were the second highest of the year, after the week ending 16 March 2023.

- Weekly inflation-adjusted ADR and RevPAR were in arrears to 2019 and below last year’s levels.

The U.S. Top 25 Markets finished the week at 73.3% occupancy, up 2.6 ppts WoW. Markets outside of the Top 25 increased similarly (+2.4 ppts WoW) to 64.4%. Top 25 occupancy has been above 70% for the past five weeks.

ADR in the Top 25 Markets increased 4.3% WoW to US$195, while all other markets experienced a smaller increase (0.7%) to US$137.

Monday through Wednesday occupancy for the Top 25 Markets increased 0.8 ppts WoW to 73.3%, while Friday-Saturday occupancy increased 8.9 ppts to 81.8%. The large gain was due to easy comparisons to the previous weekend, which was ahead of Mother’s Day. A similar WoW pattern was seen outside the Top 25 Markets with Monday through Wednesday occupancy increasing 1.3 ppts WoW and weekend occupancy gaining 6.6 ppts WoW.

Graduations, concerts, and sporting events buoyed many markets during the week. Among the Top 25 Markets, four markets surpassed 80% occupancy, all increasing more than 4ppts from the previous week.

- New York City topped the chart at 89.5%, holding the top spot among the Top 25 for the seventh straight week and achieving its highest occupancy of the year to date. And for the fourth week in a row, New York also led the nation in occupancy. Commencement ceremonies for Columbia University and New York University, among many other events, impacted performance. Long Island and nearby New Jersey markets (Bergen/Passaic and Newark) also reached their peak occupancy levels for the year.

- Washington, D.C. (83.2%) achieved its highest occupancy since the start of the pandemic, which was also due to two large graduation events (Georgetown and George Washington) among other events.

- Boston (82.2%) also hit its highest occupancy of the year thanks to college graduations, notably Boston University, as well as the Taylor Swift tour that took place in Foxborough. Due to the location of the stadium, two other markets outside the Top 25 (Worcester and Providence) also appear to have benefited from the tour.

- Las Vegas (82.1%) reached its fourth highest occupancy of the year. The weekend’s Electric Daisy Carnival (EDC), which spills into next week, contributed to the market’s strong performance.

- Two additional top 25 Markets (Denver and Seattle) also achieved their highest occupancy of the year.

Markets outside the Top 25 achieving notable occupancy levels were Rochester, NY (77.3%), host of the PGA Championship, Knoxville (76.4%), host of the University of Tennessee’s graduation, and Baltimore (76.2%), host of the Preakness Stakes.

Group bookings at luxury and upper upscale hotels are settling into the end-of-conference-season patterns. Demand increased 3.1% WoW and declined 3.3% YoY. In the next week of data, we will see group decline as expected during the weeks surrounding the Memorial Day weekend. Transient bookings at luxury and upper upscale hotels increased 3.5% from the prior week and were 2.6% above last year’s levels.

- The majority of the Top 25 Markets (16 of 25) experienced a WoW transient increase, while on the group side, the majority (17 of 25) experienced a WoW group decrease.

- The strongest group markets week over week were Houston, Minneapolis, Oahu, and San Francisco.

- The strongest transient markets week over week were St. Louis and Washington, D.C.

Global Performance

Global occupancy (excluding U.S.) was 68.8% for the week, up 7.3 ppts from the comparable week last year. Occupancy has indexed at 97% of 2019 values for the past six weeks. If occupancy continues at this pace and follows 2019, it will trend up until mid-August. Weekly ADR rose 18% YoY to US$142 with RevPAR at US$98 (+32%).

Among the top 10 countries, based on supply, occupancy reached 71.5%, a slight increase week over week of 2.2ppts and 10.1ppts YoY. ADR was up 15.4% with RevPAR increasing 34% to US$97, which was the highest level since the start of the pandemic.

- The U.K. led with occupancy of 82.5%, its second highest this year (29 April at 82.8%) and ahead of the comparable week in 2022 by 10.1 ppts. Looking ahead, Forward STAR data show this buoyancy in occupancy continuing for the next 90 days as occupancy on the books is up 4ppts from the same time last year.

- It was a rocking week for France as it hosted big concerts, including Metallica and Bruce Springsteen and one of the major European medical conferences EuroPCR. As result, ADR increased 27% above the previous week to US$310.

- China continues to see the greatest YoY gains in occupancy, up 22.5 ppts.

Outside of the Top 10 countries, Ireland had the world’s highest occupancy at 88.7%, followed by Singapore (82.6%).

Final thoughts

U.S. and global results point to a return to normal patterns. Graduations, concerts, and sporting events are driving market level performance while leisure travel in general remains strong. Group is slowing as spring convention seasons wanes, and business/corporate improves with continuing gains in weekday occupancy. ADR remained firmly grounded with positive annual gains, although the rate of ADR and RevPAR growth is moderating and will continue to do so.

Looking ahead

Going back to normal will be key to understanding performance fluctuations over the next two weeks. Based on the previous 20 years, expect occupancy for the week before Memorial Day (week ending 27 May) to be flat to slightly up with ADR following suit. For the week containing the holiday (week ending 3 June), performance will be impacted by a significant drop in both measures. The comparison to 2022 will likely be even more turbulent. Prior to the pandemic, Memorial Day occupancy averaged a drop of 25ppts WoW. Last year, the drop was considerably less (-18ppts). Thus, if occupancy follows its normal pattern, as we predict, the YoY comparison will seem alarming but it’s not. It's what we should expect and what we have seen in the past.

This article originally appeared on STR.