This article briefly discusses the Indian hotel sector's performance in the first half of the calendar year 2023.

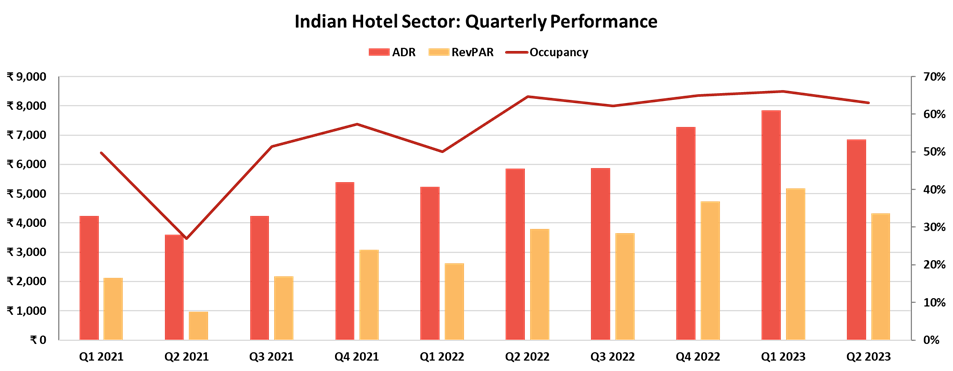

Demand patterns in the Indian Hotel sector are normalizing after the severe fluctuations of the past three years. Even though revenge travel is gradually declining, demand in the leisure segment remains strong. Meanwhile, the MICE segment and corporate travel segment are continuing to recover, despite the hybrid work culture, online meetings, and higher airfares slowing the turnaround rate. As a result, the sector witnessed an average nationwide occupancy rate of 63-65% in the first half of the calendar year 2023 (H1 2023), showcasing an increase of 6-8 percentage points (pp) from the same period in 2022. India’s average hotel rates saw a strong increase of 30-32% in H1 2023 compared to H1 2022 and were 21-23% higher than in H1 2019. The steady rise in average rates helped the nationwide RevPAR to reach INR4,650-4,850, reflecting a growth of 46-48% compared to H1 2022.

The year got off to a good start with the nationwide occupancy rate breaching the 70% mark in February 2023, a first since the pandemic. Consequently, the occupancy rate of 65-67% in Q1 2023 was 15-17 pp higher than in Q1 2022, which was impacted by the Omicron wave and the reintroduction of travel restrictions in the country. Average rates, meanwhile, experienced a year-on-year increase of 49-51% in Q1 2023, helping RevPAR to almost double during this period.

Demand began to stabilize in Q2 2023, with the occupancy rate reaching 62-64%, which was similar to Q2 2019 levels but 1-3 pp lower than Q2 2022. Average rates continued to rise during the quarter and were 16-18% and 23-25% higher than Q2 2022 and Q2 2019, respectively.

Despite the impressive performance in H1 2023, the sector still has not been able to catch up with its all-time peak performance in 2007. The occupancy rate for H1 2023 is 6-8 pp lower than H1 2007, while average rates are 8-10% lower (without adjusting for inflation which would further impact the rate significantly), although it is important to keep in mind the large growth in inventory, which has increased more than threefold since 2007.

Source: HVS Research

Mandeep S. Lamba, President – South Asia, oversees the HVS practice in South Asia. Mandeep has spent over 30 years in the hospitality industry having worked with International Hotel Companies such as Choice Hotels, IHG and Radisson Hotels before becoming President for ITC Fortune Hotels in 2001. Having successfully built the Fortune brand in India’s mid-scale hospitality sector, Mandeep ventured into an entrepreneurial stint for over 8 years, setting up JV companies with Dawnay Day Group UK and Onyx Hospitality Thailand before joining JLL in 2014, as Managing Director, Hotels & Hospitality Group – South Asia. An established industry leader, Mandeep has won several awards and recognitions for his accomplishments. Recently, he was featured in the Hotelier India Power List of the most respected hoteliers in India for the second year in a row. Contact Mandeep at +91 981 1306 161 or mlamba@hvs.com.

Dipti Mohan, Senior Manager - Research with HVS South Asia, is a seasoned knowledge professional with extensive experience in research-based content creation. She has authored several ‘point of view’ documents such as thought leadership reports, expert opinion articles, white papers and research reports. Contact Dipti at dmohan@hvs.com.

Dhwani Gupta, Associate - Research with HVS South Asia, studied literature for her undergraduation and believes that you can do anything with the right amount of research. After graduating, she pursued a course in Management and Liberal arts which gave her a wider perspective of the world. As a result, the more difficult a topic is, the more fun she has writing it. Contact Dhwani at dgupta@hvs.com