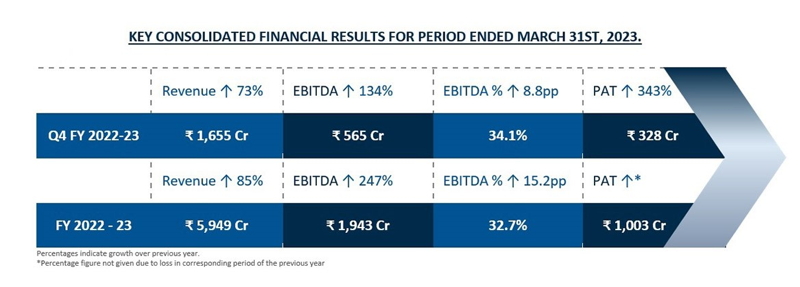

- FY23 REVENUE AT INR 5,949 CRORES, UP 85% YoY

- FY23 EBITDA MARGIN AT 32.7%, UP 1523 BPS YoY

- FY23 PAT AT INR 1,003 CRORES, OFFSETS COVID LOSSES

The Indian Hotels Company Limited (IHCL), India’s largest hospitality company, reported its consolidated financials for the fourth quarter and full ending March 31st, 2023.

Commenting on the FY23 performance, Mr. Puneet Chhatwal, Managing Director & CEO, IHCL, said, “IHCL achieved a record setting year with a number of significant accomplishments including the highest ever full year consolidated revenue, an all-time high and industry leading EBITDA margin and PAT of over INR 1,000 crores a historic first for the company. This performance was enabled by consecutive four quarters ofsustained high demand, additionally bolstered by IHCL demonstrating RevPAR leadership across its brandscape in all its key markets.

IHCL crossed 260+ hotels in its portfolio including 36 signings at a rate of 3 hotels a month and 16 openings or a new hotel every three weeks in the year. IHCL’s vast footprint now covers 31 States and Union Territories in India. We were also able to achieve an optimal 50:50 mix between our owned/leased and managed hotels.”

He added, “IHCL’s performance reflects the affection and loyalty of our guests, the continuous guidance and support from our Board and the remarkable passion and commitment of the 28,000-strong IHCL team. The management’s focus remains on value creation for all stakeholders, offering customers a unique hospitality ecosystem across segments, leading the way in engaging local communities in our value chain, pioneering new destinations in the country and delivering continued superior performance.

| TAJ REACHES LANDMARK 100TH HOTEL MILESTONE |

|

| RECORD PORTFOLIO GROWTH & ACHIEVES BALANCED PORTFOLIO |

|

| REIMAGINED AND NEW BUSINESSES |

|

| DRIVING SUSTAINABLE BUSINESS |

|

Mr. Giridhar Sanjeevi, Executive Vice President and Chief Financial Officer, IHCL said, “Robust demand across markets and segments hasled to all group companiesreporting a full year positive PAT in domestic operations. Growth in same store performance supported by margin enhancing new businesses and asset light growth has led to a record EBITDA margin of 32.7%, an 8.7 percentage points expansion over FY 2019-20. This has been made possible by maximising operating leverage of our owned/leased hotels and margin enhancing fee-based business. IHCL continues to report a healthy consolidated free cash flow of INR 1,017 crores in FY 2022- 23 and remains net cash positive.”