Benchmarking is essential to every hotel brand's growth strategy, from five-star luxury resorts to serviced apartments, and everything in between. Benchmarking allows you not only to understand your hotel’s performance compared to the market, but to pinpoint areas for improvement.

Traditional hotel benchmarking generally focuses on comparing rates and occupancy, without shedding light on how the results came to be. Today, however, hotels can access new benchmarking technology that takes a fresh approach, providing real-time insights to help you break down the entire booking funnel and compare your hotel's direct booking performance to the competition.

Within an interactive platform, dynamic competitive sets provide invaluable insights to help you unravel the building blocks of your direct channel strategy. In addition to looking at data for these metrics, from website conversion rates and LOS to Disparities and Average Booking Value, you can easily drill down on the data using filters by source, travel party, country, and more.

Knowing how to analyze these data, how to determine areas for improvement, where opportunities lie, and what actions to take can be baffling for even the most seasoned hoteliers. To make the concept more simple to grasp, we have broken down two use cases, showing step by step how hotels are using the analytics to take full advantage of benchmarking their direct channel.

Sound interesting? Let’s take a closer look at their journey with benchmarking data

Case 1: Capitalizing on reservations from top source markets

Analyzing the data

In this case, we are cross-filtering three key metrics of the property’s direct booking channel (website visits by visitor country rank, total website conversion rate, and overall revenue) and comparing them to similar hotels in the same destination, as well as to a custom compset handpicked by the hotel. Using these metrics, we will be able to identify the main source markets for the hotel’s website traffic, whether these lookers are being successfully turned into bookers or not, and how much they spend on average.

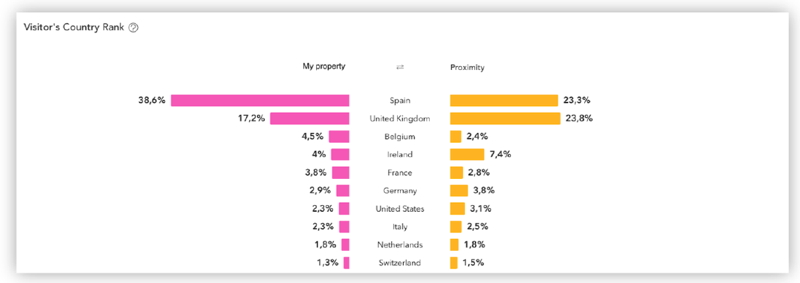

First, we take a look at the visitor country rank to see the origin of the guests searching for a stay on the hotel’s website. Comparing the hotel’s distribution of visitors by country to that of the proximity compset, we see that the UK is the second biggest source market in both cases.

Visitor Country Rank for website visits

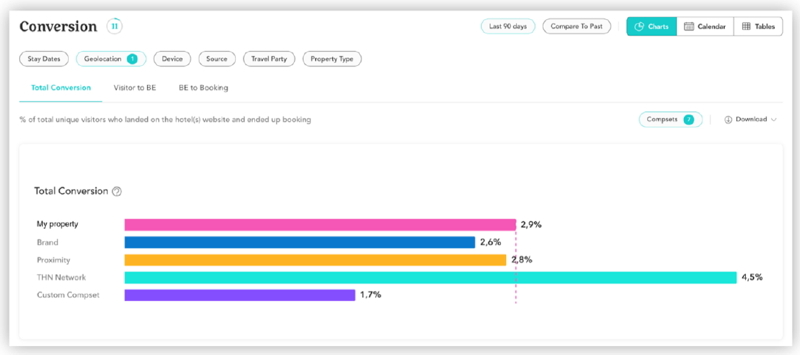

To understand more about how UK traffic is behaving, we need to look at the Total Website Conversion rate by filtering the information specifically to the UK market. From the dotted pink line in the graph below, we can see that the hotel has a higher website conversion rate than the proximity compset. This means that the hotel is able to convert more UK website visits into actual stays compared to similar hotels in their destination.

Total Conversion Rate for website visits from the UK

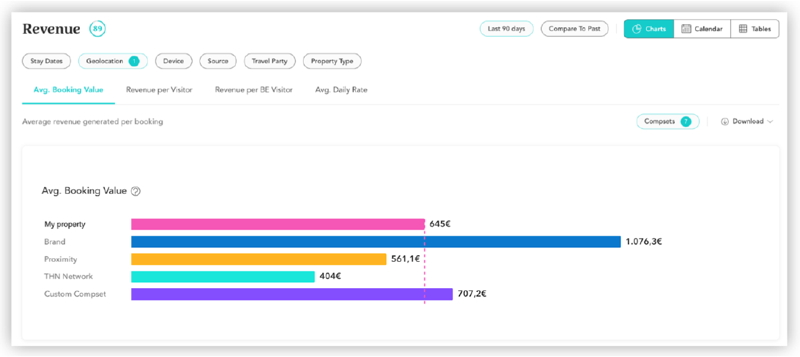

However, when looking at the Revenue tab filtered by country, we see in the graph below that the hotel’s average booking value for UK visitors is lower than other hotels within their own brand, as well as within the custom compset they handpicked to compare performances. In other words, despite the hotel’s website being quite effective at converting UK visitors, it is underperforming in terms of the average booking value of those conversions.

Average Booking Value for website visits from the UK

Identifying the Opportunity

While the hotel is performing well when converting UK visitors into bookings, the data indicate that visitors from the UK are potentially willing to spend more on hotel bookings. This presents an opportunity for the hotel to adopt new tactics aimed at boosting the average booking value of the conversions on their website coming from the UK.

Adopting Best Practices

An effective way to achieve this is by tailoring the website experience for the UK market. With today’s personalization technology, it’s possible to create website messages and offers specifically for the UK market, and to use targeting rules to show these only to relevant users.

For instance, a hotel could use eye-catching messaging to encourage UK visitors to upgrade to a higher-value room type, or entice visitors to book additional services such as late check-out or breakfast.

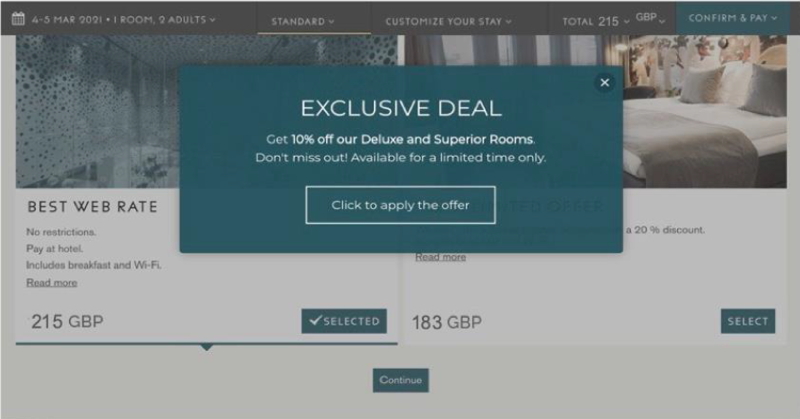

A hotel can take any number of creative approaches to tempt visitors to spend a little extra on their reservation. We’re including the example below as it has proven to be highly successful, generating excellent results. As you can see in the image, the hotel is displaying a layer promoting an exclusive offer for higher-value room types. Shown on the booking engine and only targeted towards visitors who are searching from the UK, the message includes a 1-click promo code. This means that the offer is automatically applied for those visitors who click directly on the CTA (call-to-action), removing the need to show an actual promo code, thus limiting the diffusion of the discount online.

By promoting this attractive upselling deal to UK visitors, who we know have the potential to be high-value guests, the hotel can expect to persuade them to spend a little more, helping to boost direct revenue.

Layer with a 1-click promo code for UK visitors

Case 2: Tackling price disparities

Analyzing the data

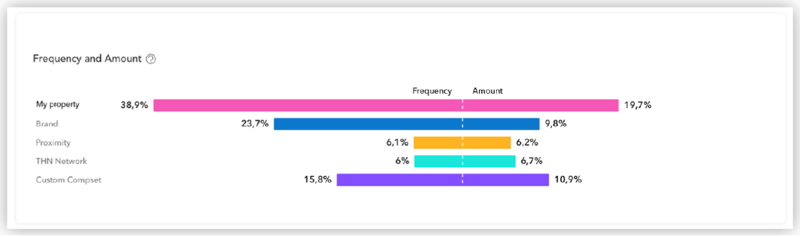

In this example, we take a deeper look at how price disparities can affect bookings, and how to combat this issue. An important metric to analyze is a hotel’s performance in terms of price disparities, looking at both the Amount (% difference in rate) and Frequency (how often the rate is undercut). The hotel’s rate is being undercut with a higher frequency than all of the other compsets. The issue for the hotel is that users will often be able to find a better rate for the same stay on OTAs or other online channels, which will obviously have a negative impact on their own website’s conversion rate.

Price Disparity comparing amount and frequency

Identifying the Opportunity

Based on the high level of price disparities detected in the hotel’s data, there is an opportunity to convert more website visitors by decreasing how often the hotel’s own rates are being undercut by third parties. One way to achieve this is by using a rate parity solution. For example, the hotel could analyze patterns to see what the root cause may be, such as an issue in a particular market or room category. In parallel, the hotel should also find a way to guarantee the best available rate on their website.

Adopting Best Practices

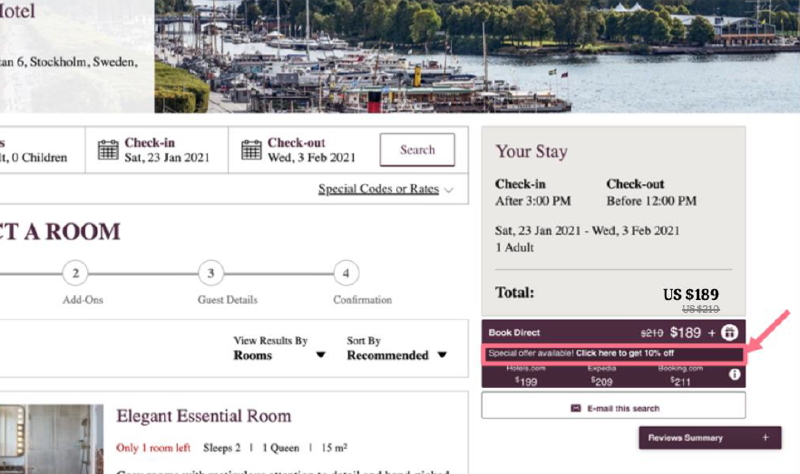

An effective way for the hotel to fight against price disparities in real time and encourage more direct reservations is by activating a Price Match tool on the booking engine.

With this feature, whenever a price disparity is detected, the visitor is presented with a discounted rate to match it. With just one click on the special offer link, the discount is automatically applied to combat the lower rate available elsewhere.

Price Match feature automatically applying discount to fight against lower rate

These are just two examples of the ways hotels can use their website benchmarking data to boost conversion rates. There are, in fact, more than 30 KPIs related to a hotel’s website performance that provide valuable insights when tracking and comparing results to multiple compsets. The key is taking a two-step approach: learn and act. Start by drilling down on your key data to identify quick wins and opportunities to drive additional revenue. Then, take action where it matters most — make changes at critical points within the booking funnel, test tailored messaging or launch new campaigns. By following this benchmarking journey, you will have all the necessary building blocks to craft an impactful strategy for your hotel's website.

Fiona Gillen is the VP Marketing at The Hotels Network. Connect with Fiona on LinkedIn.

© Copyright 2023 Hotel Electronic Distribution Network Association (HEDNA)