A record number of loyalty program members should help hotel brands lower their customer acquisition costs, increase direct-to-consumer engagement and offset any occupancy shortfalls during an economic downturn.

A record number of loyalty program members should help hotel brands lower their customer acquisition costs, increase direct-to-consumer engagement and offset any occupancy shortfalls during an economic downturn.

Direct access to a base of loyal customers is a benefit to owning and operating a branded hotel. Loyalty members can help drive occupancy during off-peak periods or weaker economic conditions.

Loyalty members redeemed a record number of points in 2022 that were earned and saved during the pandemic. Publicly available loyalty program metrics of five major U.S. hotel brands suggest that it may take may take more points than in the past to book certain hotel rooms, which is consistent with record-high average daily rates (ADRs), or that more guests are booking stays at resorts, all-inclusive properties and more expensive destinations in prime locations.

An analysis of several metrics suggests that average loyalty program members may be less valuable than they were in the past. This may not be true of top-tier members.

Over the past 10 years, room nights, loyalty members, loyalty program liabilities and redemption revenues may have been influenced by accounting changes, brand mergers & acquisitions, dispositions, rebranding and dynamic point pricing. Efforts were made to check for outliers, but this analysis should not be considered same-store.

Assessing the loyalty landscape

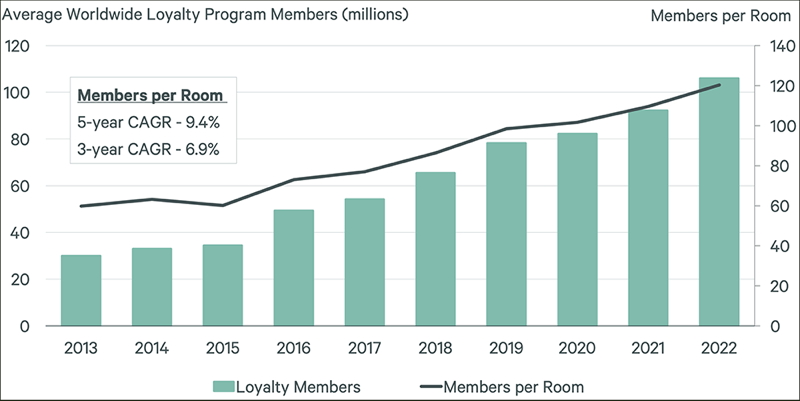

The number of loyalty program members has been growing faster than total room supply over the past 10 years, helping to expand the potential base of guests and reduce customer acquisition costs. Although this trend would be expected to increase the occupancy contribution from loyalty members, their share actually held relatively steady at 47% over the past five years. This suggests that either 1) the average member contributes less in terms of occupancy, 2) the pandemic-led shift away from traditional business travel to leisure travel has resulted in less brand stickiness or 3) there has been a temporary disruption in loyalty member booking patterns driven by the pandemic. If the shift is temporary, we expect to see growth in occupancy contribution as trends normalize.

Figure 1: Loyalty program members per room continued to increase, even during the pandemic

Source: Marriott, Hilton, Hyatt, Wyndham and Choice public filings.

When hotel loyalty program members earn points for their stays, airline travel, credit card purchases or activity with other affiliated partners, a liability is created on the balance sheet of the brand parent representing the potential future value of those point redemptions.

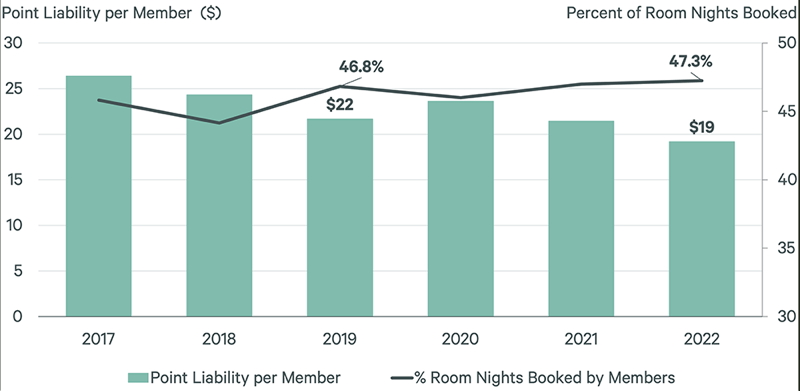

Hotels’ outstanding point-liability-per-member has been declining since 2020, which suggests that the average member may be earning fewer points and may contribute less to overall occupancy per person over the near to medium term. The average point liability per member fell to a new low of $19 last year, down from $22 in 2019 and $26 in 2017. Two other reasons for this decline could be a devaluation of the liability associated with each point or an increase in the value of points redeemed, which lowers the outstanding liability.

Figure 2: Occupancy contribution from loyalty program members has held relatively steady since 2017

Source: Marriott, Hilton, Hyatt, Wyndham and Choice public filings.

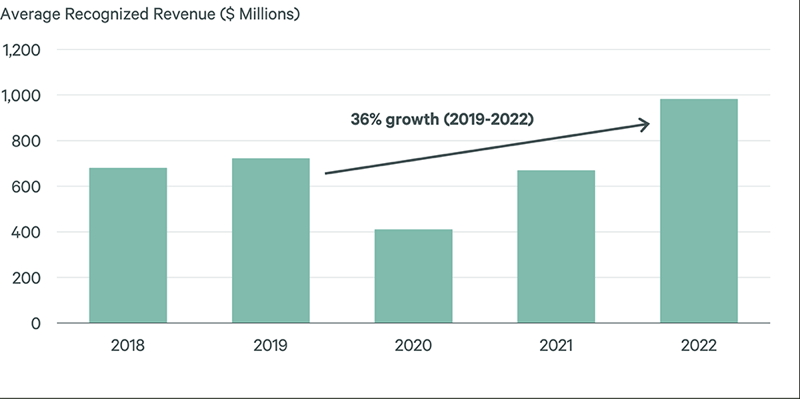

The total value of loyalty point redemptions and “other” revenues increased to $982 million last year, up 36% from 2019’s previous record of $721 million. If the revenue associated with point redemptions is increasing, but the occupancy contribution from points on average is not, it could indicate that, on average, it takes more points to book a room. This likely is due to either a combination of the variable number of points needed to reserve rooms and record-high ADRs across the U.S. or that points are being redeemed for more expensive properties such as full-service resorts or prime locations.

Figure 3: Record revenue recognition of loyalty point redemptions over the pandemic

Source: Marriott, Hilton, Hyatt, Wyndham and Choice public filings.

Even though the average member has a lower value than prior to the pandemic, we cannot conclude anything specific about the highest-yielding or top-tier members. The five hotel brands we analyzed only disclose aggregate loyalty metrics. It could be that the brands’ most loyal customers are as loyal or more so than they were prior to the pandemic, but the proliferation of credit card programs and other strategic alliances have led to more inactive or lightly active members at the margin.

Nevertheless, the 35% growth in the average number of loyalty members and 22% increase in the number of members per room since 2019 means that the major brands now have the largest database of potential guests in their history. This should continue to reduce customer acquisition costs and help provide “occupancy insurance" should the economy falter.