The relationship between the hotel brands and their franchisees was favorable and constructive in 2020. Both recognized that the impact of COVID was largely out of their control, and the best chances for both entities to survive relied on cooperation.

In 2020, the average hotel in CBRE’s annual Trends® in the Hotel Industry survey experienced a 108 percent decline in earnings before interest, taxes, depreciation and amortization (EBITDA), resulting in an EBITDA margin of -5.5 percent. For hotels, EBITDA represents the cash flows from operations that are used to fund debt service and provide returns to investors. This is by far the greatest decline in EBITDA since CBRE began tracking the performance of the U.S. lodging industry in the 1930s.

Facing such traumatic declines in profitability and insolvency, hotel owners reached out to their lenders, investors and vendors to gain some relief from their expense obligations. Given the uncontrollable circumstances that caused the precipitous decline in performance, most of these related parties were sympathetic and provided some reprieve.

Among the compassionate partners that were sensitive to the plight of hotel owners in 2020 were the franchisors. In general, most brands relaxed required service and amenity standards and delayed deadlines for property renovations. This allowed owners to cut operating costs and utilize cash reserves that had been designated for capital projects.

However, the franchisor/franchisee relationship was not as generous during 2020 regarding franchise-related fees owners pay to the brand. Most franchise-related fees are charged as a percent of rooms revenue. Therefore, by assessing the relative changes in rooms revenue and franchise fees we can make some assumptions.

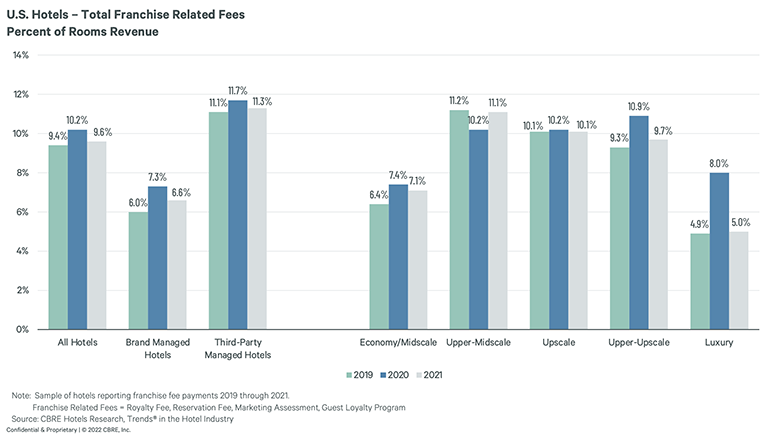

CBRE analyzed the franchise-related payments made by 3,013 U.S. hotels each year from 2019 through 2021. Before COVID in 2019, these hotels averaged 171 rooms and achieved 71.2 percent occupancy with a $159.80 average daily rate (ADR).

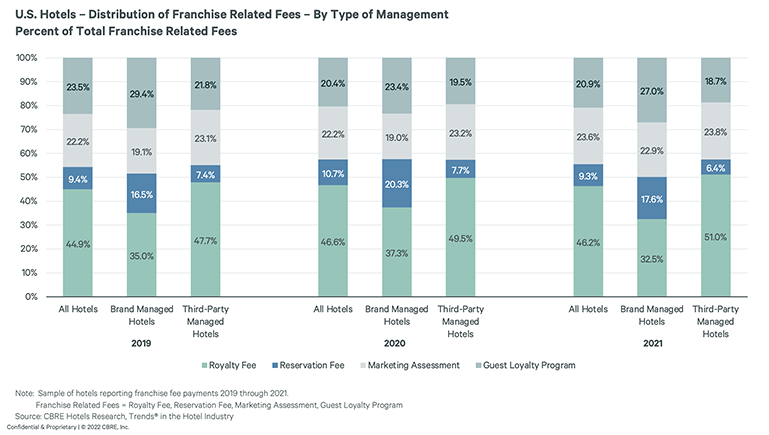

For our Trends® in the Hotel Industry survey CBRE captures four different franchise-related fees on a discrete basis.

- Royalty payments

- Marketing assessments

- Reservation fees

- Guest loyalty program fees

For this analysis, the sum of these four components comprises “total franchise-related fees.”

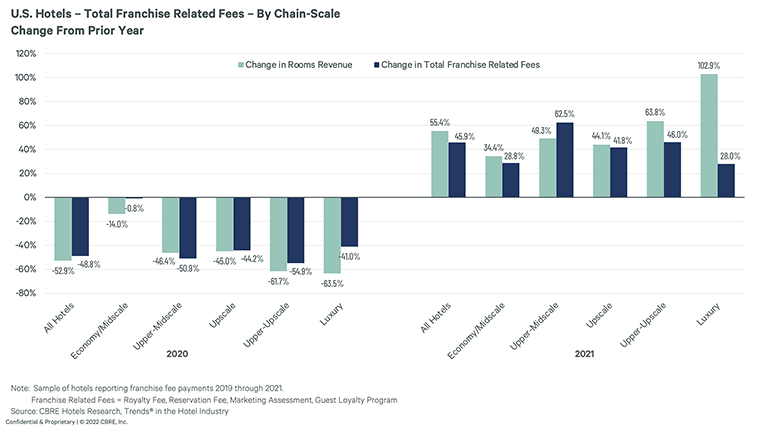

2020 Annual Changes

From 2019 to 2020, the hotels in our sample averaged a decline in rooms revenue of 52.9 percent. Concurrently, total franchise-related fees decreased by 48.8 percent. With franchise-related fees declining less than rooms revenue, it does not appear that franchisors offered many (if any) concessions regarding fee obligations during 2020.

Among all the franchise fee components, reservation fees declined the least, implying that a greater percentage of revenue was earned from guests booking through the hotel reservation system. Conversely, the greatest percentage decline was observed in payments made to support the brand’s guest loyalty programs. This is reflective of the decline in frequent corporate travelers who are members of the loyalty programs.

We noticed a disparity in the change of franchise payments made by hotels that were operated by a brand, versus those operated by a third-party management company. From 2019 to 2020, rooms revenue at the brand managed hotels in our sample experienced a 55.3 percent fall-off in rooms revenue and a 46.3 percent decline in franchise-related fees. This is a difference of nine percentage points. Conversely, third-party managed hotels suffered a 51.7 percent drop in rooms revenue and a 49.2 percent decline in franchise-related fees, for a difference of just 2.5 percentage points.

When sorting the sample by chain-scale, we find the greatest percentage point differences at the pricing extremes of the chain-scale spectrum. Fortunately for the owners of economy and midscale hotels, rooms revenue declined by just 14 percent, but franchise-related payments dropped by only 0.8 percent. Luxury hotels suffered the greatest fall in revenues (-63.5%) but saw their franchise-related fees decline by just 41 percent.

Upper-midscale properties appear to have benefited from the generosity of the franchisors. Rooms revenue at these properties fell by 46.4 percent during 2020, but the franchise-related payments made to their brands declined by an even greater 50.9 percent.

Relief In 2021

Possibly in response to feedback from owners, or observations made after watching hotel owners suffer for a full year, the relative changes in revenues and franchise-related fees swung in favor of the franchisees in 2021.

From 2020 to 2021, the rooms revenue for the hotels in our analytical sample increased by 55.4 percent, but franchise-related payments grew by just 45.9 percent. Reservation system-related fees lagged the most in the rise (+26.6%), while payments made to support the marketing and advertising campaigns of the brands increased the most (+54.8%). Of note is the 49.1 percent increase in guest loyalty program payments, which is greater than the 45.9 percent increase in total franchise-related payment. This is indicative of the beginning of the return of corporate travelers in 2021.

Based on feedback from our clients, the relationship between the hotel brands and their franchisees was favorable and constructive in 2020. Both recognized that the impact of COVID was largely out of their control, and the best chances for both entities to survive relied on cooperation. Concessions regarding brand standards and deferred renovations helped owners who suffered from a lack of cash. However, it appears that franchisors needed the lifeline of fees from owners to sustain their ability to continue to promote the brand and drive business to their franchisees.

Robert Mandelbaum is Director of Research Information Services for CBRE Hotels Research. Adam Barry is Vice President of Sales for CBRE Network Advisory Services. To benchmark the IT department expenses of your hotels, please visit pip.cbrehotes.com/benchmarker. For more information about an IT inventory, please contact Adam at adam.barry@cbre.com. This article was published in the June 2022 edition of Lodging