Only 17% of executives strongly agree that there will be a recession in the next six months - As executives see external risks ease, they are channeling their investments into transformation, technology and talent

After three years of navigating economic uncertainty and complex challenges, business leaders are increasingly optimistic about the economic and business environment and their companies’ ability to mitigate risk, according to the latest PwC Pulse survey: Focused on reinvention. Only 17% of business leaders strongly agree there will be a recession in the next six months. And while executives are still concerned about cyberattacks, talent and the US regulatory environment, they view these as less of a risk today than a year ago.

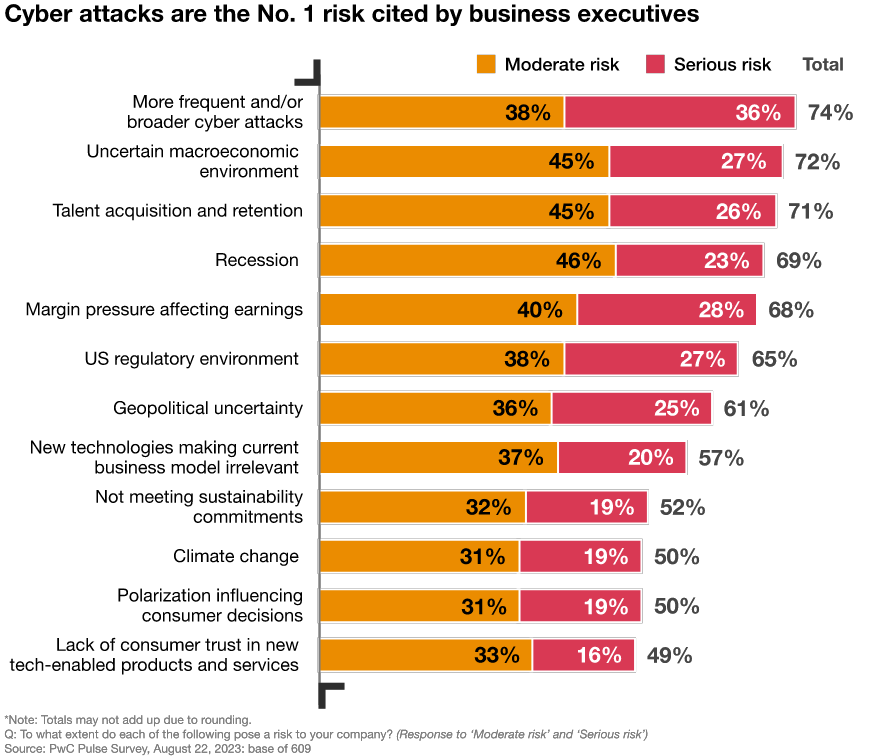

When we dive into what issues are still on executives’ radar, frequent and/or broader cyber attacks is the top-cited risk, with 74% saying it is a serious or moderate risk. In addition, while business leaders appear hopeful about a soft landing, the future of what the economy looks like is still a question. More than a quarter (28%) of executives cite margin pressure affecting earnings as a serious risk.

Business leaders doubling down on transformation and tech investments but need to start unlocking value

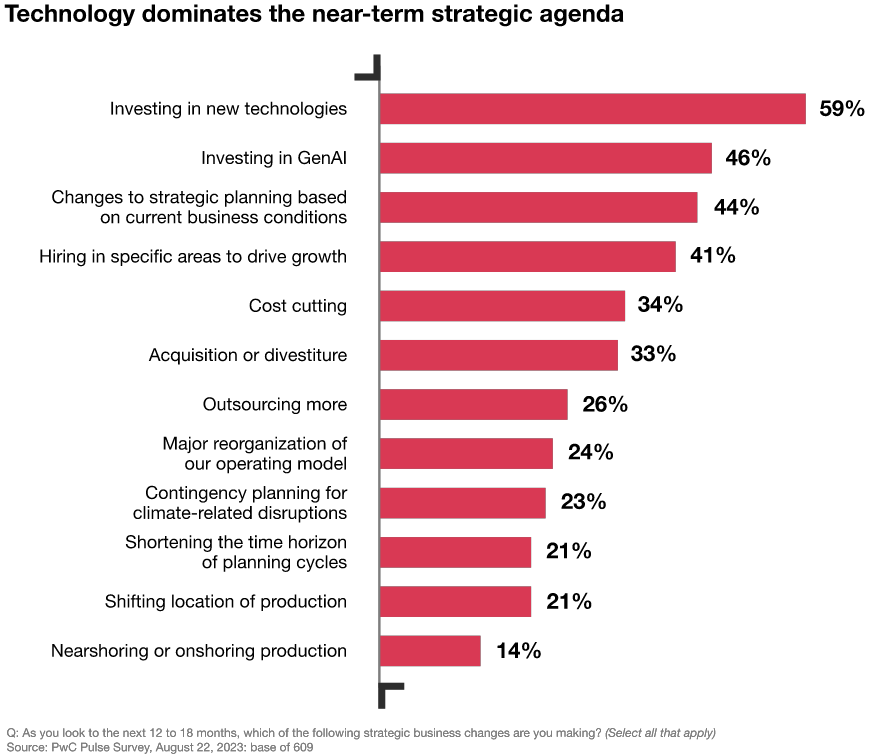

As businesses see external risks ease, they are focusing inward to transform and reinvent their companies for the future. Executives are strategically channeling their investments into technology and transformation with over one in two leaders saying they will invest in new technologies (59%) and 46% saying they will invest in generative AI (GenAI) specifically in the next 12 to 18 months. Given AI has been predicted to contribute a notable amount to the global economy in the near future, there is an opportunity here for even more executives to opt in now and invest in the technology or risk falling behind.

“Business leaders have continued to demonstrate resilience and adaptability while navigating a complex environment in recent years,” said Neil Dhar, Vice Chair - US Consulting Solutions Co-Leader, PwC US. “As worries about the economy ease, executives are increasingly comfortable future-proofing their businesses by pursuing investment alternatives focused on growth and operating model efficiencies — all underpinned by technology and a focus on delivering outcomes for their stakeholders.”

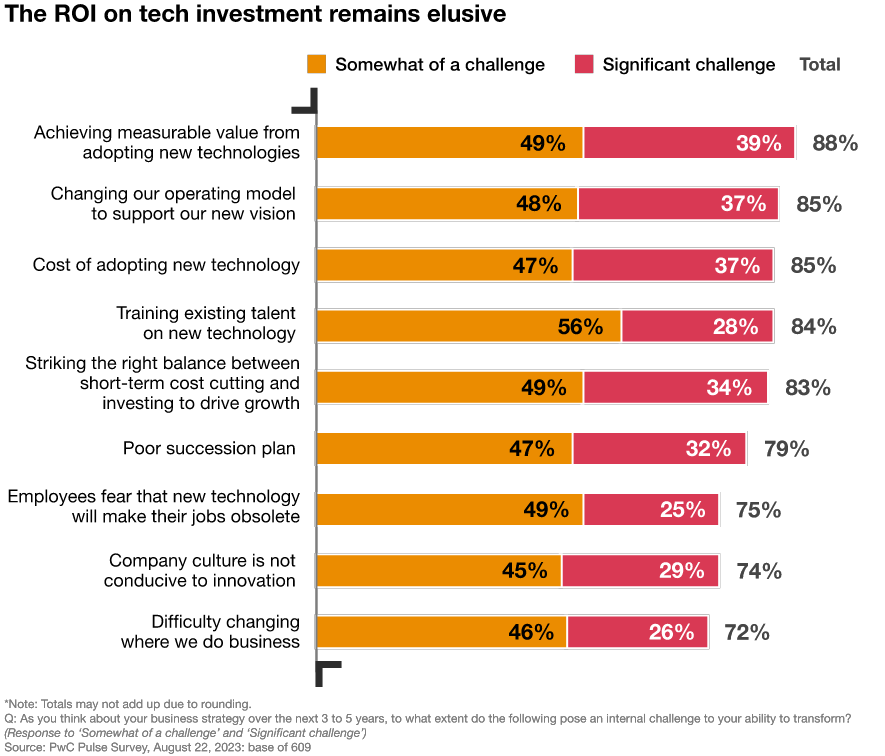

Looking at the next three to five years, embedding new technologies into their business model is the top-ranked strategic priority — but it also creates the most challenges. Business leaders’ top challenges to their companies’ ability to transform largely center around tech, including achieving measurable value from new tech (88%), the cost of adoption (85%) and training talent (84%).

"Emerging technologies — especially AI and generative AI — are catalyzing a transformative influence, reshaping customer experiences, enhancing productivity, and deepening risk sensing activities. Their immense value, when harnessed responsibly, is undeniable,” said Wes Bricker, Vice Chair - US Trust Solutions Co-Leader, PwC US. “Yet, it’s not just about the technology itself, but the synergy between people and AI platforms, which requires new skills and ways of working. Prioritizing upskilling is critical in the seamless integration of new technologies to create sustainable value.”

As executives continue to focus on business transformation and growth, they’re shifting their attention toward developing and retaining current talent following past cycles of hiring and subsequent layoffs. Many are prioritizing upskilling initiatives and improving benefits, with more than six in 10 executives saying they have implemented or plan to expand mental health benefits (64%), train employees on new technology (64%) or increase compensation for existing employees (60%).

Executives monitoring potential impact of climate and public policy

When it comes to sustainability and the impact of climate, executives are split: 50% of executives cite climate change as a risk to their business. While the majority (69%) of leaders agree they're prepared to comply with upcoming sustainability reporting requirements, only 23% are actively contingency planning for climate-related disruptions in the next 12 to 18 months — an opportunity for companies to invest in greater resilience measures.

Finally, as we move into an election year, business leaders are keeping an eye on key policy areas. The majority (82%) of executives say they are monitoring closely or actively engaging policymakers around cybersecurity, and 68% say they are monitoring closely or actively engaging policymakers around privacy. And as GenAI remains top of mind for many business leaders, more than half (61%) say they are monitoring closely or actively engaging policymakers around regulatory and legislative action around GenAI.

For more information and to view the full report, visit www.PwC.com.

Key survey results

To what extent do each of the following pose a risk to your company?

As you look to the next 12 to 18 months, which of the following strategic business changes are you making?

As you think about your business strategy over the next 3 to 5 years, to what extent do the following pose an internal challenge to your ability to transform?