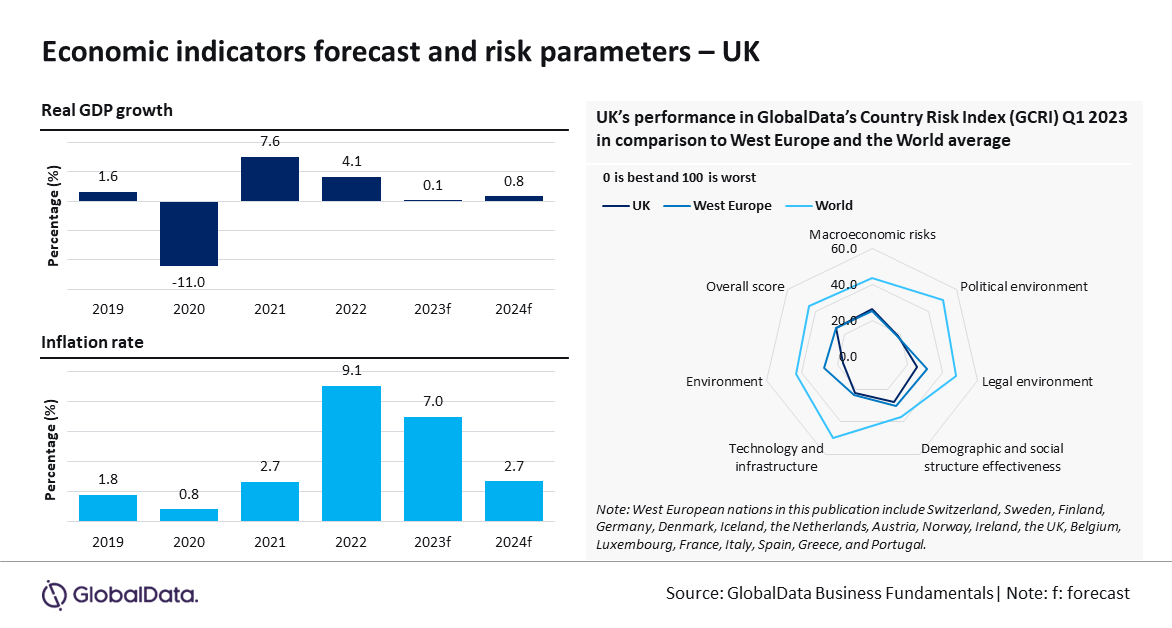

The UK is poised for a modest economic upturn due to lower energy prices, government support measures, and a robust labor market. However, trade prospects may remain lacklustre due to the sluggish economies of major trading partners. Businesses also face a high cost of financing which remains another area of concern. In line with this scenario, the country is set to record a marginal growth of 0.1% in 2023, diverging from previous contraction outlook, forecasts GlobalData, a data and analytics company.

GlobalData’s latest PESTLE Insights report, “Macroeconomic Outlook Report: UK,” reveals that although the UK economy is projected to witness marginal growth in 2023, it represents a notable slowdown compared to the 4.1% growth achieved in 2022. The British economy grew by 0.1% on a quarterly basis in Q1 2023, unchanged from Q4 2022 and up from (-)0.1% in Q3 2022. The services, construction, and manufacturing sectors experienced modest growth, while education, health, public administration, and transport sectors declined. Stagnant household spending was offset by positive contributions from business and government investment.

Although the inflation rate is projected to ease, it is expected to stay at an elevated level of 7% in 2023, down from 9.1% in 2022 but much higher than the Bank of England’s target of 2%. The Bank of England intervened to tame high inflationary pressure by increasing its policy rate 11 times by a total of 425 basis points to 4.5% in May 2023. Slowing but elevated inflation along with tax hikes is projected to keep the domestic demand subdued. GlobalData projects the real household consumption expenditure to contract by 0.5% in 2023 as compared to 3.9% growth in 2022.

Bindi Patel, Economic Research Analyst at GlobalData, comments: “High food prices are raising concerns of a potential food crisis, despite a decrease in energy prices. Food inflation has remained above 10% since July 2022 and fluctuated between 12% and 19% from July 2022 to May 2023. This has resulted in a cost-of-living increase for 95% of adults in Great Britain, as of May 2023 according to UK Parliament, leading to a surge in demand for food bank charities such as the Trussell Trust. These economic challenges highlight the pressing issue of affordability and access to essential food supplies.

In terms of sectors, financial intermediation, real estate, and business activities contributed 34.4% to the gross value added (GVA) in 2022, followed by mining, manufacturing (13.6%) and wholesale, retail, and hotels activities (12.9%), according to GlobalData estimates. In nominal terms, the three sectors are expected to grow by 4.8%, 4.6% and 4.7%, respectively, in 2023 as compared to 9.9%, 9.6% and 9.7% in 2022.

On the policy front, the UK government implemented spending cuts and tax hikes to restore the financial credibility of the UK. However, these measures have resulted in nearly 3 million low- and middle-income individuals paying basic or higher-rate tax for the first time, beginning in April 2023, due to the freeze on income tax thresholds. While these actions are aimed at improving the country’s fiscal position in the future, they may have an ongoing impact on domestic demand.

The UK is categorized as a very low-risk nation and ranked 24th out of 153 nations in GlobalData Country Risk Index (GCRI Q1 2023). The country’s overall risk score is lower than the West European and the world average in the GCRI Q1 2023. The UK performed well in legal, technological and infrastructure parameter, and environmental parameters when compared with the West European average.

Patel concludes: “The UK’s establishment of 70 free trade agreements as an independent nation as of February 2023, with additional agreements in the negotiation process, provides an optimistic outlook for the country. These agreements are expected to solidify the UK’s global position and contribute to sustained economic growth in the coming years.”