Most management contracts include an incentive management fee in addition to the base management fee. The incentive fees are designed to make management more conscious of the bottom line since owners achieve their returns and pay their debts from profits, not revenue. Incentive management fees are earned by the operator once a designated profit threshold is achieved

Given the depressed performance of hotels during the 2020 industry downturn, unsurprisingly almost no hotel owners paid an incentive fee to their managers that year. Fortunately for U.S. hotel operators, incentive fees have risen concurrent with the recovery of hotel profits. In 2022 incentive payment levels began to return to pre-COVID levels.

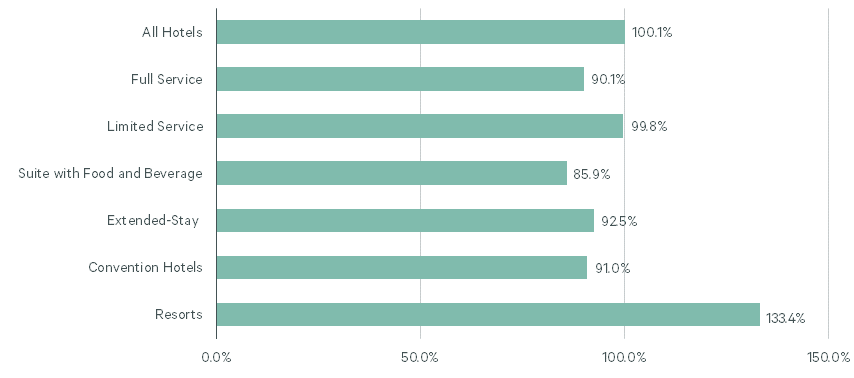

Figure 1: 2022 Total Management Fees as a Percent of 2019 Total Management Fees

Source: CBRE Hotels Research, Trends® in the Hotel Industry (2022 estimated as of March 2023).

To gain a better understanding of recent incentive management fee trends we analyzed the performance of 1,203 hotels that reported paying an annual management fee (base and/or incentive) from 2019 through 2022 for CBRE’s annual Trends® in the Hotel Industry survey. In 2022, the research sample averaged 170 rooms in size, and achieved an average occupancy level of 65.9% along with an average daily rate (ADR) of $198.68.

Decline from 2019 to 2020

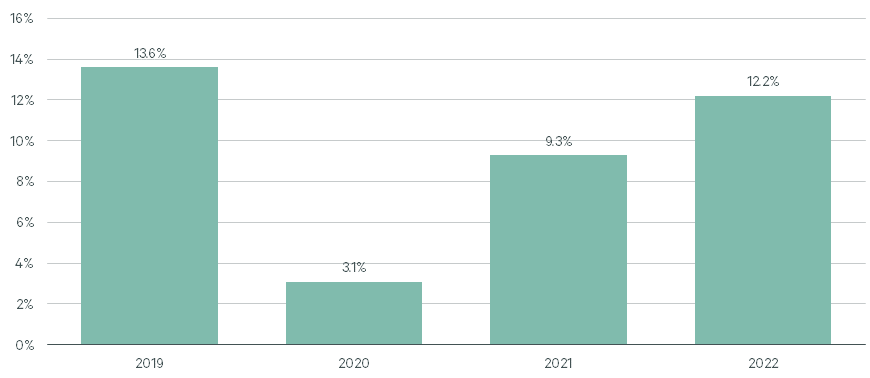

Before the industry recession in 2020, 13.6% of the properties in our research sample reported an incentive fee payment. During 2019, total management fees averaged $2,153 per available room (PAR), or 3.2% of total operating revenue. Of the $2,153 PAR, $240 PAR was paid as an incentive fee.

In 2019, Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA) were 24.5% of total operating revenue. The $240 PAR in incentive fee payments averaged 1.4% of the $16,596 PAR EBITDA level.

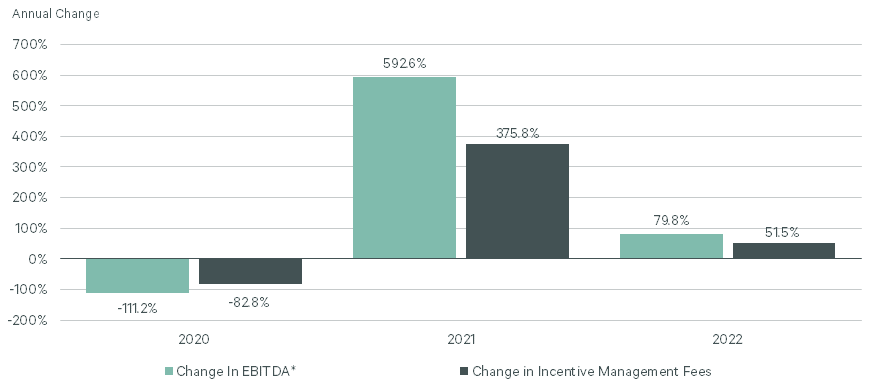

Because of the COVID-induced decline in travel, hotel EBITDA declined by 111.2% from 2019 to 2020. Accordingly, the percent of properties in the research sample paying an incentive fee dropped to 3.1%. Consistent with the relative strength of leisure demand, most of the few properties that paid an incentive fee in 2020 were located in remote leisure destinations. In 2020, the average EBITDA margin for the hotels that paid an incentive fee was 16.5% of total operating revenue. This compares with -7.2% for the total sample.

Figure 2: Change in EBITDA* and Incentive Management Fees

Note: * Properties reporting a management fee payment in Trends® in the Hotel Industry sample.

Source: CBRE Hotels Research, Trends® in the Hotel Industry (2022 estimated as of March 2023).

Comeback in 2021 and 2022

In 2021, 9.3% of the research sample reported an incentive fee payment. This rose to 12.2% in 2022.

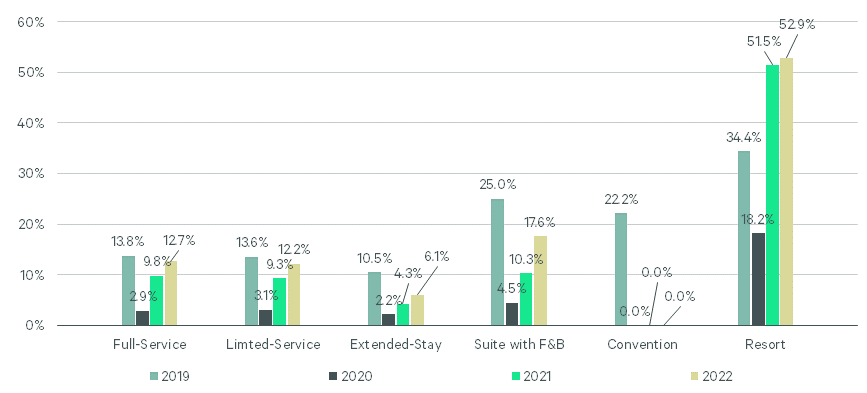

Among the six property types tracked by CBRE, resort operators have been the most frequent recipients of incentive fee payments. In 2022, 52.9% of resort hotels reported the payment of an incentive management fee. This is greater than the 34.4% ratio observed in 2019. Not surprisingly, none of the convention hotel operators in our sample earned an incentive management fee in 2020, 2021, or 2022. This is consistent with the lag in recovery of group demand compared to leisure travel.

Figure 3: Percent of Properties* that Paid an Incentive Management Fee

Note: * Properties reporting a management fee payment in Trends® in the Hotel Industry sample.

Source: CBRE Hotels Research, Trends® in the Hotel Industry (2022 estimated as of March 2023).

Figure 4: Percent of Properties* that Paid an Incentive Management Fee by Property Type

Note: * Before deductions for capital reserve, interest, income taxes, depreciation, and amortization.

Source: CBRE Hotels Research, Trends® in the Hotel Industry (2022 estimated as of March 2023).

In 2022, EBITDA for the research sample averaged $16,442 PAR. This is 99.1% of 2019 levels. For comparison, incentive management fee payments exceeded their 2019 levels by 23.9% in 2022. During 2022, incentive fee payments averaged 13.8% of total management fee payments, and 1.8% of EBITDA. It appears that ownership generously rewarded those managers who were able to achieve profit growth during an extremely difficult operating environment.

Management Contract Trends

Changes in the economy continue to play a part in the relationship between owner and operator. This will likely not change going forward because the economy has an impact on hotel demand, operations and profitability.

- Capital Expenditures – due to the COVID-19 pandemic, many brands granted forbearance (essentially delays) on Property Improvement Plans (PIPs) and any required capital expenditures on franchisees. However, operators and owners are sharing with us that brands are now requiring outstanding PIPs and capital be rectified and completed within the next 18 months.

- Consequently, due to these capital expenditure programs being executed during 2023, the financial performance of the hotel is being impacted as some components of hotels may be “out of order” (rooms, amenities), thus negatively impacting performance.

- Termination provisions are becoming more favorable for owners and are, in some cases, tied to financial performance. Financial performance is generally tied to the incentive management fees. Therefore, if performance thresholds (i.e. the budget) are not met, then incentive management fees will not be paid.

Negotiating a management agreement in the current environment requires owners and investors to carefully review how the management fees are paid and the thresholds from which the incentive management fees are based. Owners are considering the following criteria when negotiating incentive management fees:

- The near- and longer-term economic outlook for the market and for the subject property.

- The stage at which the subject property is in its “life-cycle”. For example, older hotels that are architecturally fatigued may be largely impacted by newer hotels entering the market. Thus, upward financial improvement may be limited. A more aggressive incentive management fee might be required for the operator.

- The personality of management company leadership needs to match the owner to insure alignment. Financial objectives and values need to be aligned.

- Experience with the subject property type and chain-scale are very important.

Robert Mandelbaum is Director of Research Information Services for CBRE Hotels Research. Tim Dick, Ph.D., leads CBRE Hotels Southeastern Advisory Practice and serves as the National Practice Leader of the Hotels Asset Management practice. To manage and benchmark the performance of your management company, please contact Tim at tim.dick@cbre.com. This article was published in the April 2023 edition of Lodging.